However, this will jessica and company rely on the extent of the conditions - prices can fall to listed below 3% if the unfavorable credit history has actually been worked out and also took place more than three years earlier. If you were paying 3.95% on a ₤ 150,000 negative debt home mortgage over 25 years, you would certainly pay ₤ 788 a month as well as ₤ 236,286 in total. A mortgage rate, otherwise referred to as passion, is what a loan provider charges a borrower to obtain a home loan. A set rate suggests the home loan price will certainly stay consistent through the entire lending term. A variable price will certainly vary throughout the term based on a benchmark rate.

- If you have actually paid your rent, utilities, or other expenses on schedule, try to get them included.

- Consequently, you might prefer to wait up until any type of defaults or various other adverse credit has gone away from your credit score documents prior to applying for a home loan.

- Lenders take a look at factors such as the prime rate to determine their prices.

If you have a low credit report or maybe timeshare maintenance fees been declined by various other lending institutions we can assist. We can likewise assist encourage you on buy to allow home loans if you have inadequate credit scores. Also just paying your broadband contract on schedule monthly reveals loan providers than you can handle your finances. MIG is an expanding property home mortgage loan provider in the Southeast building on a tried and tested record as a long-time industry leader.

Bankrate.com is an independent, advertising-supported author and also comparison solution. We are compensated in exchange for placement of funded products and also, solutions, or by you clicking on specific links published on our site. For that reason, this settlement may impact how, where and in what order products show up within listing classifications. Various other elements, such as our very own proprietary site guidelines and whether an item is used in your location or at your self-selected credit rating array can also affect just how as well as where items appear on this website.

Rental repayments aren't typically included on your credit history report. But solutions such as RentTrack, ClearNow, ERentPayment, and also RentReporters can get your on-time rental background consisted of, which can help increase your debt. If you're dealing with paying down debt as well as you've paid all your current costs promptly, lending institutions might be open to offering a financing despite having imperfect credit history.

You Can Purchase A Home With Bad Credit Score, Yet Should You?

For example, those with a repossession on their debt documents might be able to obtain a property finance from professional companies within 1-- 3 years if they put down a 25% deposit. For instance, if you are attempting to obtain a mortgage with a CCJ, it's most likely to be accepted than a mortgage for an applicant with several credit scores issues. You need to note that you might not need to pay every one of the above, as some lending institutions offer comprehensive bargains and also things like Stamp Task might not be payable in particular circumstances.

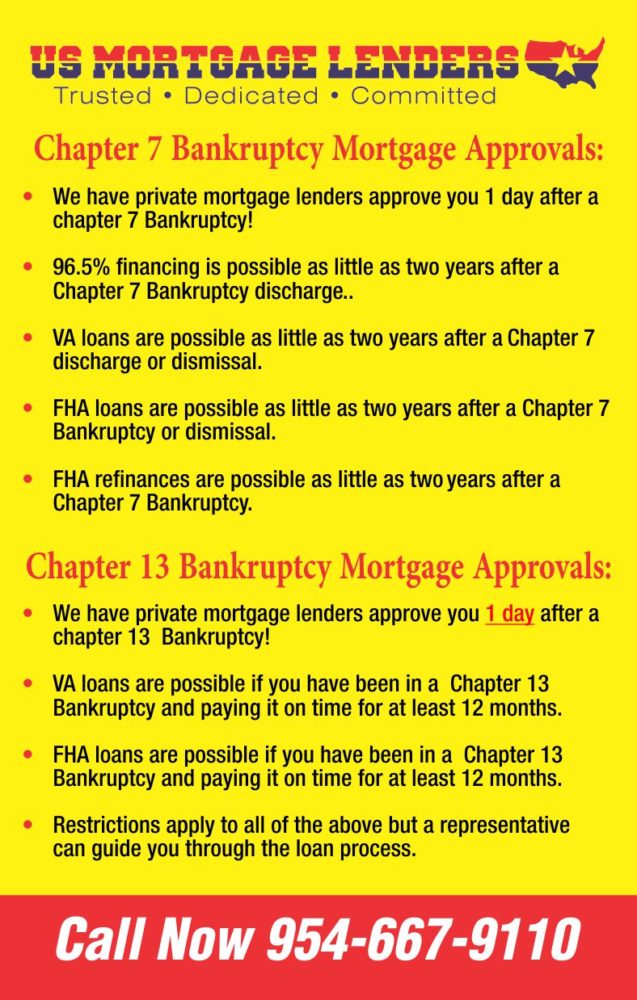

Bankruptcy Home Mortgage

Bad credit rating mortgages do exist, and also you can still receive a mortgage in spite of an inadequate credit report. People with debt issues can still recognize the dream of homeownership. If you can, spend at least 6 months working with your credit timeshare cancellation score by paying for debt and also attempting to get collections accounts eliminated before you make an application for a financing to provide you much more choices and also better financial savings. Find out more concerning techniques for improving your credit to receive more desirable home loan terms at BadCredit.org.

Lenders will be interested in what bad credit report you have specifically. They'll look at the day it took place as well as whether the repayments for any type of financial debt management strategies or finance arrangements have actually been paid in full and also on schedule. These kinds of home mortgage contracts bring even more danger to the lending institution who can shed cash if you were to end up being unable to repay your mortgage. That's why the loan providers that approve poor credit report can charge greater levels of rate of interest.